All Categories

Featured

Table of Contents

[/image][=video]

[/video]

Thinking passion prices stay strong, also higher guaranteed prices might be possible. Making use of a laddering approach, your annuity profile renews every couple of years to maximize liquidity.

Rates are assured by the insurance policy firm and will certainly neither raise neither reduce over the chosen term. We see rate of interest in short-term annuities supplying 2, 3, and 5-year terms.

Carpenters Union Annuity Fund

Which is best, simple interest or intensifying rate of interest annuities? The answer to that depends on just how you utilize your account. If you don't plan on withdrawing your passion, after that typically uses the greatest rates. The majority of insurer only offer compounding annuity policies. There are, nonetheless, a couple of plans that credit rating simple rate of interest.

Everything depends on the underlying price of the dealt with annuity agreement, certainly. We can run the numbers and contrast them for you. Allow us understand your intentions with your interest earnings and we'll make suitable suggestions. Skilled repaired annuity financiers know their premiums and rate of interest gains are 100% easily accessible at the end of their selected term.

Unlike CDs, fixed annuity plans enable you to withdraw your passion as income for as long as you wish. And annuities supply higher rates of return than practically all equivalent financial institution tools supplied today. The other item of excellent information: Annuity prices are the highest possible they have actually remained in years! We see substantially even more passion in MYGA accounts now.

There are a number of very rated insurance coverage companies contending for deposits. There are several well-known and highly-rated business offering affordable yields. And there are agencies specializing in score annuity insurance coverage companies.

Insurance companies are typically risk-free and safe establishments. A few that you will see above are Dependence Standard Life, sister firms Midland and North American Life, Americo, Oxford Life, American National, Royal Neighbors, Pacific Guardian Life, Athene, Sagicor, Global Atlantic, and Aspida to name a few.

They are safe and trustworthy policies made for risk-averse financiers. The financial investment they most closely look like is deposit slips (CDs) at the bank. View this brief video to understand the similarities and distinctions between the two: Our clients acquire dealt with annuities for several factors. Safety of principal and guaranteed rates of interest are absolutely 2 of one of the most essential factors.

Convert 401k To Annuity

These policies are extremely adaptable. You might want to postpone gains now for bigger payouts throughout retirement. We give items for all scenarios. We help those needing prompt rate of interest earnings currently as well as those intending for future earnings. It is very important to note that if you need earnings currently, annuities work best for those over age 59 1/2.

We are an independent annuity broker agent with over 25 years of experience. We help our clients secure in the greatest yields possible with secure and secure insurance coverage firms.

Over the last few years, a wave of retiring child boomers and high rate of interest rates have actually aided gas record-breaking sales in the annuity market. From 2022 to 2024, annuity sales covered $1.1 trillion, according to Limra, an international study organization for the insurance coverage industry. In 2023 alone, annuity sales enhanced 23 percent over the prior year.

Americo Financial Life & Annuity

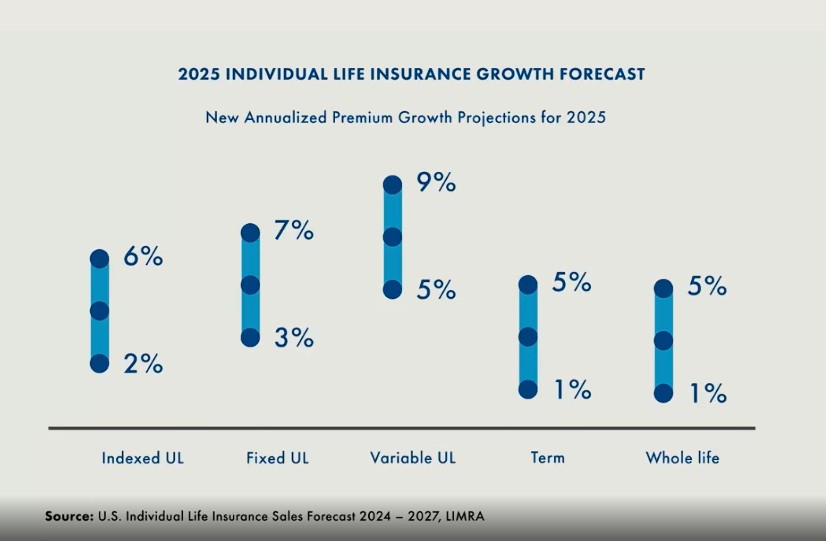

With even more potential rate of interest rate cuts coming up, uncomplicated fixed annuities which often tend to be less difficult than other alternatives on the market might come to be much less interesting consumers because of their waning rates. In their place, other varieties, such as index-linked annuities, may see a bump as consumers look for to capture market development.

These price walks offered insurance business room to offer more appealing terms on taken care of and fixed-index annuities. "Rates of interest on repaired annuities also increased, making them an appealing investment," states Hodgens. Even after the securities market rebounded, netting a 24 percent gain in 2023, sticking around anxieties of an economic downturn kept annuities in the spotlight.

Various other variables also added to the annuity sales boom, including even more banks currently using the products, claims Sheryl J. Moore, CEO of Wink Inc., an insurance policy market research firm. "Customers are finding out about annuities more than they would certainly've in the past," she says. It's also much easier to purchase an annuity than it used to be.

"Essentially, you can use for an annuity with your agent with an iPad and the annuity is approved after completing an online form," Moore claims. "It utilized to take weeks to get an annuity through the concern procedure." Fixed annuities have actually pushed the current growth in the annuity market, standing for over 40 percent of sales in 2023.

Limra is expecting a pull back in the appeal of fixed annuities in 2025. Sales of fixed-rate deferred annuities are anticipated to go down 15 percent to 25 percent as rate of interest rates decline. Still, dealt with annuities have not lost their shimmer rather yet and are supplying conventional financiers an appealing return of more than 5 percent for currently.

Loss On Annuity Tax Deduction

There's also no need for sub-accounts or portfolio management. What you see (the guaranteed rate) is what you obtain. Variable annuities often come with a washing list of fees death expenditures, administrative costs and investment administration fees, to call a couple of. Set annuities maintain it lean, making them a simpler, cheaper selection.

Annuities are intricate and a bit different from other monetary items. Discover just how annuity fees and payments function and the typical annuity terms that are valuable to know. Fixed-index annuities (FIAs) damaged sales documents for the third year straight in 2024. Sales have almost increased given that 2021, according to Limra.

Caps can differ based on the insurer, and aren't likely to remain high for life. "As interest rates have actually been boiling down lately and are expected to come down better in 2025, we would certainly prepare for the cap or participation prices to also come down," Hodgens says. Hodgens expects FIAs will certainly continue to be attractive in 2025, but if you're in the marketplace for a fixed-index annuity, there are a couple of things to look out for.

So theoretically, these hybrid indices intend to ravel the low and high of an unpredictable market, yet in fact, they've typically fallen short for consumers. "Many of these indices have actually returned bit to nothing over the previous pair of years," Moore says. That's a hard pill to ingest, thinking about the S&P 500 uploaded gains of 24 percent in 2023 and 23 percent in 2024.

The even more you study and look around, the much more likely you are to discover a credible insurer going to offer you a decent rate. Variable annuities once controlled the market, yet that's changed in a large way. These items suffered their worst sales on record in 2023, dropping 17 percent contrasted to 2022, according to Limra.

Present Value Of An Annuity Due Table

Unlike fixed annuities, which offer downside protection, or FIAs, which stabilize safety with some growth possibility, variable annuities supply little to no defense from market loss unless bikers are added at an included expense. For capitalists whose leading priority is preserving resources, variable annuities just do not measure up. These items are likewise infamously intricate with a history of high fees and large surrender fees.

When the market collapsed, these bikers ended up being obligations for insurers due to the fact that their assured values surpassed the annuity account worths. "So insurer repriced their riders to have less appealing attributes for a higher cost," says Moore. While the market has actually made some initiatives to enhance transparency and minimize costs, the item's past has actually soured lots of customers and financial consultants, that still see variable annuities with suspicion.

Convert Annuity To Roth Ira

RILAs use customers a lot greater caps than fixed-index annuities. Just how can insurance companies afford to do this?

The wide array of crediting approaches made use of by RILAs can make it tough to compare one product to another. Higher caps on returns additionally include a compromise: You take on some danger of loss beyond a set flooring or barrier. This buffer guards your account from the very first portion of losses, normally 10 to 20 percent, but afterwards, you'll shed cash.

Table of Contents

Latest Posts

Deferred Gift Annuity

Annuity Vs Dividend

The Best Annuities For March 2025

More

Latest Posts

Deferred Gift Annuity

Annuity Vs Dividend

The Best Annuities For March 2025